Founded in 1912, Illinois Tool Works (ITW, $174.06) makes construction products, car parts, restaurant equipment and more. Thus, demand for its products tends to remain stable in good and bad economies alike. Target (TGT, $118.86) might be the No. 2 discount retail chain after Walmart in terms of revenue, but it doesn’t take a back seat to the behemoth from Bentonville when it comes to dividends. «The company has a sturdy capital expenditure policy in place, helping it enhance the safety and reliability profile of its natural gas pipeline,» Zacks Equity Research notes. A.O. Smith has upped the ante on its dividend annually for 27 consecutive years.

- The following year VFC acquired streetwear brand Supreme, but also divested its occupational workwear brands and business.

- Coloplast generates 60% of sales from Europe, 23% from other developed countries and 17% from emerging markets.

- Dividend yield is one tool to use to screen for dividend stocks that are potentially worth owning.

- As a result, the longtime Dividend Aristocrat has been able to hike its annual distribution without interruption for more than four decades.

- The company generated levered free cash flow of $3.9 billion for the 12 months ended Sept. 30, 2022.

Happily for shareholders, the sudden and sharp downturn couldn’t stop SYY from hiking its dividend for a 53rd consecutive year. The company last raised its payout in April 2022 with a 4.3% bump to 49 cents per share per quarter. In August 2023, Illinois Tool Works raised its quarterly dividend by 6.9% to $1.40 cents a share, bringing its streak of annual increases to 52 years. However, the company notes that excluding a period of government controls in 1971, that streak would stretch to 58 years. The most recent increase came in December 2022 when NUE lifted the quarterly disbursement by 2% to 51 cents per share. Nucor returns an average of about $480 million in cash to shareholders in dividends alone, year in and year out.

What are the best dividend stocks?

The most recent hike, announced in February 2023, lifted the quarterly dividend by 4.5% to 46 cents per share. As a result of all that M&A, BDX boasts a highly diversified portfolio of products – and the ample free cash flow needed to support continued dividend growth. BDX last raised its payout in November 2022 with a 4.6% raise to the quarterly dividend to 91 cents a share.

Although the COVID-19 pandemic slammed the insurance industry, AFL stock returned to pre-crash levels by early 2021, helped by the market’s confidence in its dividend. And with a conservative payout ratio and four straight decades of dividend growth, that confidence is indeed well placed. That payout has been on the rise for 39 consecutive years and has been delivered without interruption for 79. Most recently, Brown-Forman last upped the quarterly ante in November 2022, by 9% to 20.55 cents per share. The list is sorted by dividend yield from high to low, and our analysis is updated daily.

15 Highest Yielding Dividend Stocks You Can Buy – Yahoo Finance

15 Highest Yielding Dividend Stocks You Can Buy.

Posted: Tue, 21 Feb 2023 08:00:00 GMT [source]

Target paid its first dividend in 1967, seven years ahead of Walmart, and has raised its payout annually since 1972. The last hike came in June 2023, when the retailer raised its quarterly disbursement by 1.9% to $1.10 a share. Income investors certainly don’t need to worry about Sherwin-Williams’ steady and rising dividend stream. The most recent hike came in February 2023 with an 8.3% increase to the quarterly payment to 65 cents per share. The $90 billion tie-up of Linde and Praxair created the world’s largest industrial gasses company.

Enterprise Products Partners

Analysts polled by S&P Capital IQ expect earnings to grow at an average annual rate of almost 10% for the next three to five years. However, the company has increased earnings per share (EPS) by 19% annually since 2013, so it isn’t likely the company’s profits will stagnate for an extended period. Led by a Neighbor’s Rewards Club with over 31 million members — a figure that grew by 19% from last year — Tractor Supply’s sales are steadier than one might think. I do not expect that this watchlist will beat VYM or SPY every month. However, I believe that a buy-and-hold investing approach leveraging the stocks presented on this watchlist will generate long-term alpha compared to the broad market.

P&G last improved its payout in April, by 6% to 79.07 cents per share. Just note that Intertek’s U.S.-listed ADRs are extremely thinly traded, sometimes only trading 100 shares or so every few days, if that. Consider using limit and stop-loss orders when dealing with this stock. Stanley Black & Decker bought Newell Tools – which includes the Lenox and Irwin brands – from Newell Brands (NWL) for $2 billion in 2016. In January 2017, it negotiated the purchase of the Craftsman tool brand from Sears Holdings (SHLDQ) for a total of $775 million over three years and a percentage of annual sales.

That’s where dependable dividend growth stocks, like the Dividend Aristocrats, come in. Companies that have raised their dividends annually for decades can give investors some comfort that their payouts will keep coming throughout the current crisis. Paltry yields on bonds make generous dividend payers one of the few places to go for income.

How Does the Payout Ratio Relate to Dividend Yield?

Specifically, companies must earn a moat rating of narrow or wide and an Uncertainty Rating of Low, Medium, or High; companies with Very High or Extreme Uncertainty Ratings are excluded. Indeed, the conglomerate’s dividend dates back more than a century. Even better, 3M has been delivering annual dividend increases to investors for 65 years. The most recent hike came in early February 2023 when the company bumped the quarterly payout by a penny to $1.50 per share. Coca-Cola (KO) has long been known for quenching consumers’ thirst, but it’s equally effective at quenching investors’ thirst for income. The company’s dividend history stretches back to 1920, and the payout has swelled for 61 consecutive years.

This can spell disaster for investors down the road if access to capital decreases. Financial information websites like Morningstar or Yahoo Finance https://1investing.in/ provide information about a stock’s dividend per share. Company quarterly SEC filings also specify the company’s dividend per share payments.

And we think the company’s management team has done an exemplary job of allocating capital. It’s also one of Morningstar’s top 33 undervalued stocks for the third quarter of 2023. Economic slowdown hurt second-quarter performance but we expect to see improvements along with the global economy in 2024, she says. The company has paid dividends of $2.80 per share in the last three years, which we expect to continue, says Olexa—though we think management will prioritize the dividend moving forward, she adds.

Evaluate the stock

It bulked up those operations with its January 2019 acquisition of Aquion for $160 million in cash. Analysts expect the company’s earnings to rise at a rate of 8% a year for the next five years, helped by the rollout of A.O. Smith water heaters at home-improvement chain Lowe’s (LOW), as well as strength across the North American market. Albemarle (ALB, $78.89) which manufactures specialty chemicals such as lithium, was tapped to join the Dividend Aristocrats in January, having secured a streak of 25 years of dividend increases in 2019.

LMT has an “A” rating for financial health and has been growing EPS at more than 20% per year. That growth is expected to slow, but it should remain a respectable 10.9% per year (average) for the next five years. The company’s April payout of 42.50 Canadian cents a share represented a year-over-year increase of 13.3%. BCE (BCE, $40.58) is Canada’s largest communications company with annual revenue of $22.7 billion. It generates approximately 54% of its sales from wireline broadband and TV, 35% from wireless, and the remaining 11% from the company’s media operations.

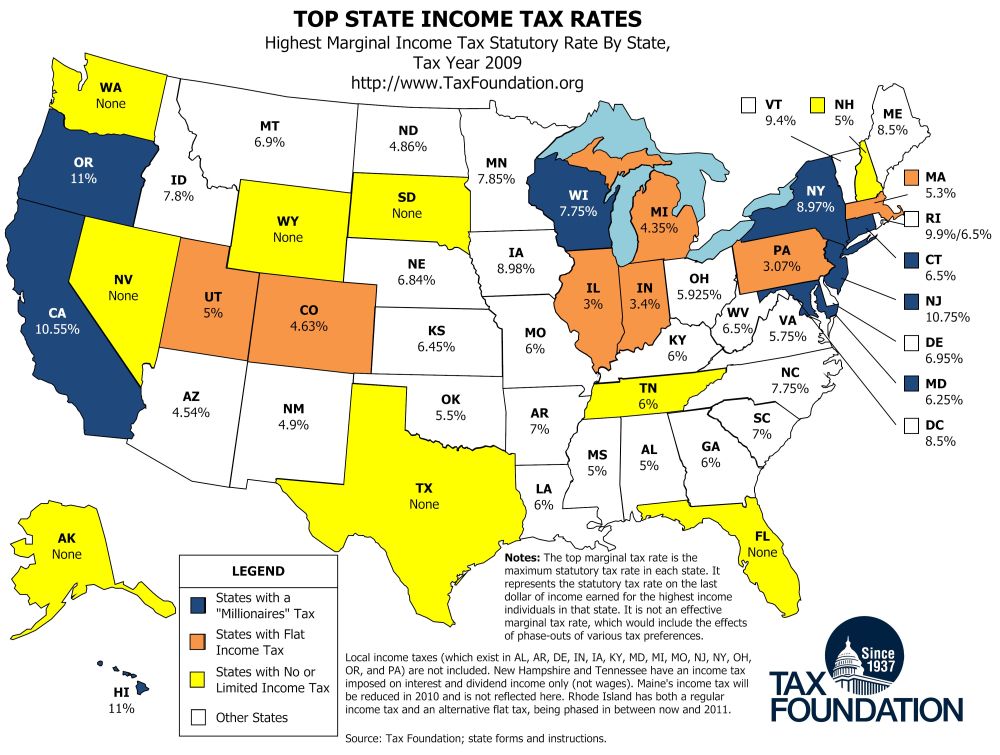

Dividend stocks or funds can be a great way to earn additional income. Keep in mind that if you own these securities in a taxable brokerage account, you’ll need to pay taxes on the income you receive, even if you reinvest those dividends. If you want to avoid taxes, you’ll need to own the shares in a tax-advantaged account such as an IRA or 401(k).

Investment decisions should be based on an evaluation of your own personal financial situation, needs, risk tolerance and investment objectives. Investing involves risk including the potential loss of principal. Based in the U.K., Amcor Plc is a global producer of packaging and related materials, including plastic jars and bottles, flexible packaging, capsules and specialty cartons. It serves businesses in the pharmaceuticals, food and beverage, health care and other industries.

American consumers buy the company’s Lindt, Ghirardelli and Russell Stover brands and have made Lindt the No. 1 player in premium chocolates and No. 3 overall in the U.S. chocolate market. Denmark’s Coloplast (CLPBY, $16.09) is the worldwide leader in ostomy and incontinence products. They’re not pretty markets, but they are growing faster than the overall medical market. The company south korea stock index also has top-five positions in wound care and interventional urology. Waste Connections last hiked its dividend in October, when it declared a 16% increase to 18.5 cents a share. Waste Connections (WCN, $98.40) is a waste services company providing garbage and recycling collection for secondary markets to more than 7 million customers in 42 U.S. states and six Canadian provinces.

20 Highest Dividend Paying Stocks Of 2023 – Forbes Advisor INDIA – Forbes

20 Highest Dividend Paying Stocks Of 2023 – Forbes Advisor INDIA.

Posted: Wed, 19 Jul 2023 07:00:00 GMT [source]

Under a new CEO, the company has been pivoting toward more cutting-edge gene therapies such as Zolgensma, which treats spinal muscular atrophy. It’s one of the first gene therapies to go on sale in the U.S. and carries a hefty $2.1 million price tag. Novartis acquired the drug through the $8.7 billion purchase of the drug’s developer, AveXis. The merged entity – minus Carrier Global and Otis Worldwide – declared its first dividend in April with a distribution of 47.5 cents a share.

Dividend Stock Frequently Asked Questions (FAQs)

The SPDR S&P Trust ETF (SPY) fell by 1.63% last month but remains up 18.65% year-to-date. Vanguard’s High Dividend Yield ETF (VYM) posted a larger loss of 2.39%, pushing its year-to-date return down to just 1.06%. Following this sour month the year-to-date return for the watchlist falls to 8.4%, well ahead of VYM but considerably worse than SPY. Since inception, November 2020, the watchlist continues to trail SPY by 0.96% and VYM by 1.96%, on an annualized basis. York is a water and wastewater utility that services three counties and 51 municipalities in south-central Pennsylvania. Its $635 million market cap and average daily trading volume of less than 40,000 shares mean few folks even know this company exists.

When it comes to dividends, however, few stocks have been steadier than FRT. Mutual fund providers have come under pressure because customers are eschewing traditional stock pickers in favor of indexed investments. However, Franklin has fought back in recent years by launching its first suite of passive exchange-traded funds.

Its latest increase – upping the quarterly dividend by a penny to $1.09 per share – was announced in August 2023. Real estate investment trusts such as Federal Realty Investment Trust (FRT) are required to pay out at least 90% of their taxable earnings as dividends in exchange for certain tax benefits. Thus, REITs are well known as some of the best dividend stocks you can buy.

United Tech was a Dividend Aristocrat until its April 2020 merger with Raytheon. Carrier Global was spun off of United Technologies – now Raytheon Technologies – as part of the merger. The company has been quick to adapt to the coronavirus crisis, implementing curb-side pick up and relying more heavily on its e-commerce platform. Although sales remain under pressure, better demand in its architectural business in North America is helping to soften the blow. Ecolab’s fortunes can wane as industrial needs fluctuate, however.

In addition to dividend yield, be sure to take a good look at the following data as well. A long-time financial journalist, Dan is a veteran of SmartMoney, MarketWatch, CBS MoneyWatch, InvestorPlace and DailyFinance. As a senior writer at AOL’s DailyFinance, Dan reported market news from the floor of the New York Stock Exchange and hosted a weekly video segment on equities. The Dividend Aristocrat grew its final fiscal-year payout by 2.4% this year to reach 17 consecutive years of income expansion. Pembina Pipeline (PBA, $23.52) is a leading North American energy infrastructure company based in Calgary, Alberta. The company’s pipelines will soon have the capacity to transport 3.2 million barrels of oil equivalent per day.

Dividend-paying companies tend to be well-established, with stable earnings and a track record of distributing a portion of them to shareholders in the form of cash or additional stock. One useful measure to gauge the sustainability of a company’s dividend payments is the dividend payout ratio (DPR), which measures total dividends divided by net income. It tells investors how much of the company’s net income is being paid to shareholders in the form of dividends compared with how much the company is retaining to invest in further growth.

TC Energy (TRP, $41.77), formerly known as TransCanada, is a leading North American energy infrastructure company that began life in 1951 as TransCanada Pipelines Limited. TransCanada announced the name change early in 2019 with the official transition on May 3, to reflect that it has operations across North America, and not just in Canada. Federal Realty Investment Trust (FRT, $79.95) is another REIT whose share-price has collapsed as a result of the coronavirus lockdown.